Polymarket API Integration

300+ Active Markets

Launch in 4 Weeks

99.9% Uptime

Fully Managed Polymarket API Integration

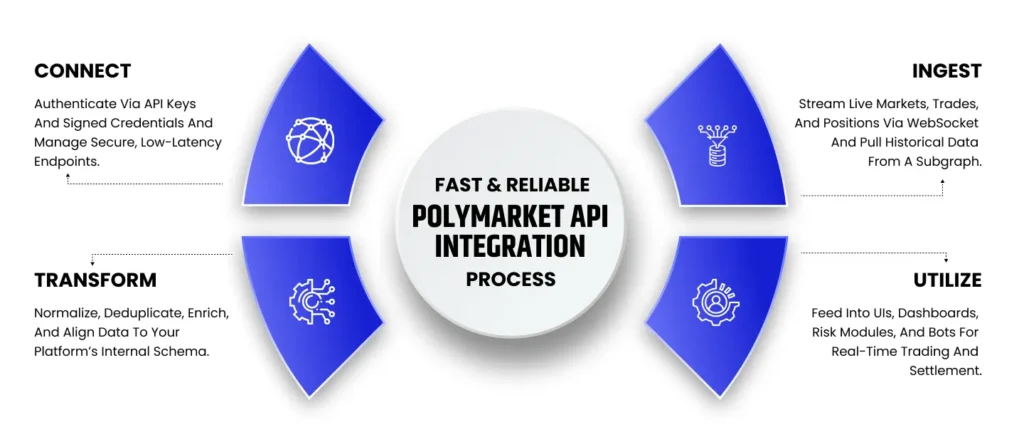

TRUEiGTECH’s in-house prediction market software development team offers a battle-tested platform layer with integrated prediction market API provided by Polymarket. We can build a complete trading and clearinghouse system platform with Polymarket’s API extracting their entire orderbook, markets, and liquidity.

With our Polymarket prediction market API integration solution, your platform will have the capacity to process more than 80 million dollars daily with 99.9% uptime. TRUEiGTECH manages everything from setup to monitoring so your platform stays fast, stable, and starts generating revenue from day one.

Key Features of Advanced Polymarket API Integration

Securely handle deposits, balances, and withdrawals within a fully integrated wallet system.

Track user activity, market performance, and key metrics in one intuitive dashboard.

Define tailored settlement rules to align market outcomes with your business model.

Connect directly to live markets, events, and trading opportunities in the Polymarket ecosystem.

Easily sort and discover markets by category, popularity, or custom operator-defined criteria.

Get instant market updates with live prices for accurate trading decisions every second.

Monitor market depth and liquidity to make informed predictions and manage risk efficiently.

Automated, verifiable settlement ensures transparent and accurate market outcomes without manual intervention.

TRUEiGTECH’s Smart Polymarket API Integration Services

Polymarket Gamma API Integration

Integrate Gamma API into your custom-built prediction market platform with Polymarket’s Gamma endpoints for high-frequency trading.

- Live market data

- Price discovery

- Settlement pulls

- Low-latency feeds

Polymarket CLOB API Integration

We connect your system to Polymarket’s central limit order book for full trading functionality.

- Order-book depth

- Trade execution

- Fill updates

- Liquidity sync

Compliance Architecture

We ensure complete compliance with prediction market platform laws for important jurisdictions like the USA and Canada.

- Geo validation

- KYC/AML gates

- Event controls

- Audit logs

Payments Infrastructure

We build secure balances, processing rails, and settlement flows for users across fiat and USDC.

- Internal ledger

- USDC rails

- Payment routing

- Wallet abstraction

Admin Console Deployment

Operator console for market oversight, user management, reporting, and direct control over Polymarket-synced events and trades.

- Market tools

- User actions

- Live metrics

- Resolution controls

Ongoing Support and Maintenance

TRUEiGTECH prediction API integration dedicated team oversees your platform to fix issues, optimize performance, and ensure stability.

- 24/7 monitoring

- Latency tuning

- API updates

- Reliability checks

TRUEiGTECH in the News | Featured in Top Media Outlets

Recognized and covered by leading global media platforms across the technology and iGaming ecosystem. Explore our recent press releases featured in top-tier publications.

What You Get with Polymarket API Integration?

| Polymarket API Deliverables | TRUEiGTECH Prediction Market Platform |

| REST API Integration | Prediction Market Platform Layer |

| CLOB Integration | Advanced Operator Admin Dashboard |

| Live Market Data | Risk and Exposure Engine |

| Order Book Data | Wallet and Payments System |

| Tradeable Events | Assured Compliance |

| Market Metadata | Localization Features |

| Historical Market Data | UI/UX Framework Development |

| Trade Positions | Rules Engine and Incentive Systems |

| Settlement and Resolution Data | |

| WebSocket Streaming | |

| GraphQL Subgraph Access |

Why Choose TRUEiGTECH for Polymarket API Integration

Our team has hands-on experience with Polymarket’s CLOB order-book and subgraph GraphQL endpoints. That means quicker build cycles, fewer surprises & full alignment with the Polymarket API architecture.

You gain plug-and-play modules that include market feed connectors, SDK wrappers, and ready-to-deploy dashboards. This means faster rollout and ability to scale as your volume or market count grows.

Integration is not the end of the line. We offer version upgrades (as Polymarket evolves its API), latency monitoring, throughput tuning, alerting and fallback strategies, ensuring your platform remains robust and competitive.

Our team offers in-depth regulatory support for integrating the Polymarket API, including compliance strategy, jurisdiction reviews, & audit-ready documentation.

We deliver transparent pricing with no revenue share, allowing operators to retain full control & maximize profits from their sportsbook operations.

We handle API key authentication, IP whitelisting, payload encryption, audit-trail logging and jurisdictional review, keeping in mind the Polymarket’s blockchain base & evolving regulatory context.