Polymex Prediction Marketplace Clone Software Development

Home Prediction Software Development Polymex Prediction Marketplace Clone Software Development

According to recent DeFi market reports, prediction market platforms like Polymex are experiencing accelerated growth with average annual user base expansion exceeding 55%. This growth is driven by demand for transparent, trustless, and efficient platforms where users can speculate on a diverse range of assets with minimal friction.

What is Polymex?

Polymex is a comprehensive decentralized prediction marketplace platform that enables users to create, participate in, and resolve prediction markets across multiple blockchain networks. It uses smart contracts to automate settlements, liquidity pools to ensure market fluidity, and decentralized oracles to verify real-world event data.

Designed to be asset-agnostic, Polymex supports a broad spectrum of cryptocurrencies and interconnected assets. Its AMM-driven design eliminates reliance on traditional order books, ensuring continuous trading availability and fair price discovery. This fosters an inclusive, community-powered ecosystem for forecasting that operates without intermediaries or centralized control.

How Does a Polymex Clone Operate?

A Polymex Prediction marketplace software clone replicates the core decentralized mechanics enabling users worldwide to stake tokens on a variety of prediction markets. Market creators configure events with parameters such as asset type, prediction interval, and staking limits through intuitive smart contract interfaces.

Liquidity is provided through AMMs, which automatically balance market supply and demand, adjusting prices dynamically based on real-time activity. Once the predicted event outcome is confirmed—via decentralized oracles feeding trusted external data—smart contracts instantly execute payouts and finalize market settlements.

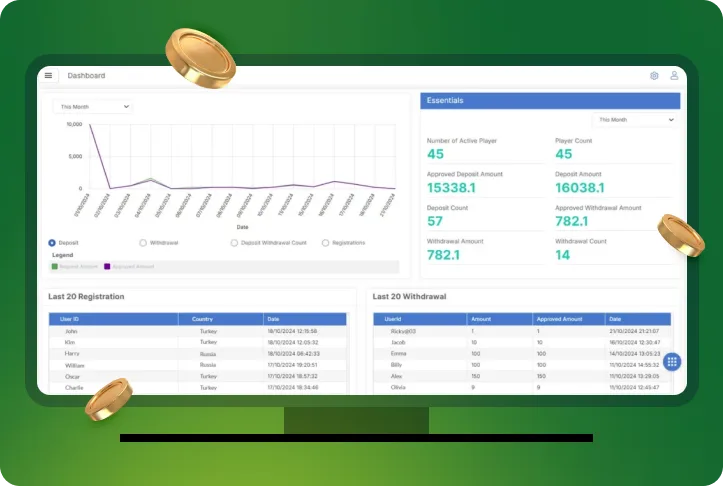

Supporting cross-chain compatibility and popular Web3 wallets, the clone ensures accessibility, low transaction costs, and a seamless user experience. Advanced dashboards offer analytics, staking status, market history, and governance participation tools to empower informed decision-making and vibrant community involvement.

Key Features of Polymex Clone Software

Participants earn passive income and incentives by staking tokens, helping to maintain liquidity and platform stability.

Token holders can influence platform development, governance policies, and fee structures through decentralized voting.

Provides real-time data on active bets, staking status, market trends, and historical predictions to empower users' strategic decisions.

Polymex Prediction Market Clone uses automated market makers to maintain continuous liquidity without traditional order books, facilitating smooth and fair trading of prediction stakes.

Supports popular Web3 wallets such as MetaMask and WalletConnect for user-friendly onboarding and transactions.

The platform supports predictions on a wide range of cryptocurrencies and other digital assets, providing greater market diversity.

Enables users to trade and participate across multiple blockchains, enhancing liquidity and global accessibility.

Fully automated settlement of prediction outcomes via smart contracts triggered by decentralized oracle data, ensuring transparency and immediate rewards.

Benefits of Deploying a Polymex Clone

AMMs ensure markets never freeze, improving usability.

Multi-asset choices attract broader audiences.

Cross-chain and optimized gas fees reduce cost barriers.

Smart contract executions guarantee trustless payouts.

Dashboard analytics and governance incentives boost retention.

Supports increased user base and transaction loads.

Revenue Model of the Polymex Clone Platform

| Revenue Stream | Description |

| Transaction Fees | Fees applied per prediction trade or stake placed. |

| Liquidity Provider Commissions | Earnings shared among token stakers/LPs securing markets. |

| Premium Features | Paid subscription services for enhanced analytics and alerts. |

| Governance Token Distribution | Token sales and allocations funding development and growth. |

| Sponsored & Branded Markets | Revenue from partnerships sponsoring exclusive prediction events. |

| API Access & Data Licensing | Offering anonymized data feeds to third parties or researchers. |

Development Process & Technical Roadmap

Requirement Gathering & Analysis

Understand market needs, user expectations, and technical specifications focusing on decentralized multi-asset prediction mechanisms.

UI/UX Design & Prototyping

Craft intuitive interfaces that simplify complex multi-chain transactions and provide transparent analytics.

Smart Contract Development & Oracle Integration

Develop secure, efficient smart contracts for market creation, staking, AMM liquidity, and automated resolution using decentralized oracle feeds.

Full Stack Implementation

Build Web3-compliant frontends and backend services, including wallet integration (MetaMask, WalletConnect), analytics dashboards, and governance tools.

Security Audits & Testing

Conduct rigorous audits of smart contracts and system tests to ensure platform robustness, vulnerability elimination, and performance stability.

Deployment & Scaling

Launch on Ethereum and Layer-2 solutions, with multi-chain scalability and performance monitoring.

Ongoing Maintenance & Upgrades

Continuously support, update, and optimize platform features based on user feedback and emerging trends.

Industry Trends & Polymex Developments (2024–2025)

Increasing user adoption driven by demand for diversified crypto asset forecasting.

Automated Market Makers continue to be favored for liquidity provision and improved trading experiences.

Expanding protocols to address scalability, gas fees, and interoperability challenges.

Empowered token holder voting shapes platform development and monetization decisions.

Gamification and staking rewards retain users and encourage active participation.

Compliance & Security Considerations

Adaptive compliance solutions tailored to regulatory requirements for decentralized financial platforms.

Mandatory external audits and real-time vulnerability assessments.

Ensuring GDPR and applicable data protection standard adherence.

On-chain records combined with moderator tools for efficient conflict resolution.

Cost Estimation for Custom Polymex Clone Development

| Development Component | Estimated Cost Range (USD) | Description |

| UI/UX Design | $8,000 – $18,000 | Focus on multi-asset clarity and real-time data visualization. |

| Backend Development | $40,000 – $82,000 | Smart contracts, AMM, oracle integration, staking and liquidity logic. |

| Frontend Development | $26,000 – $56,000 | Wallet integration, dashboards, notifications, governance modules. |

| Wallet & Payment Integration | $8,000 – $15,000 | Secure crypto wallet connectivity and transaction facilitation. |

| Testing & Security Audits | $9,000 – $19,000 | Comprehensive audits and penetration testing. |

| Maintenance (Annual) | $19,000 – $36,000 | Ongoing support, monitoring, feature updates, and scaling. |

Estimated Total Cost Range: $110,000 – $226,000

Why Choose TRUEiGTECH for Polymex Clone Development?

Polymex stands out for its liquidity-driven prediction mechanics. TRUEiGTECH recreates this strength by building markets where liquidity pools, price curves, and odds continually adjust based on user participation.

We tailor your Polymex clone to support multiple prediction formats—binary markets, multipliers, timed contests, and category-specific predictions—giving your platform full flexibility and innovation.

Our blockchain engineers develop and thoroughly audit smart contracts that manage liquidity, market creation, position buying/selling, settlements, and payouts with complete transparency.

We seamlessly integrate major Web3 wallets and can deploy your platform across Ethereum, Polygon, BNB Chain, Avalanche, or any EVM-compatible network to reach a wider user base.

With KYC/AML tools, geo-blocking, admin controls, and transparent reporting, TRUEiGTECH ensures your Polymex-style prediction marketplace meets global regulatory standards while supporting decentralized governance.

Built to handle heavy liquidity flow, large user participation, and rapid market creation, our architecture ensures fast execution and lightning-quick settlements even at peak activity.

From integrating new market types and analytics dashboards to UI/UX enhancements, liquidity features, and periodic security updates, TRUEiGTECH ensures your Polymex clone stays competitive and future-ready.

Prediction Market Platform Development | Kalshi Prediction Market Clone Software | Polymarket Prediction Market Clone Software | Augur Prediction Market Clone Software | Better Fan Prediction Market Clone Software | Duel Duck Prediction Market Clone Software | Plotx Prediction Market Clone Software | Oriole Insight Prediction Market Clone Software | Hedgehog Prediction Market Clone Software | Prejection Finance Prediction Market Clone Software | Probo Prediction Market Clone Software | Zeitgeist Prediction Market Clone Software | Manifold Prediction Market Clone Software | Predictit Prediction Market Clone Software | iowa Prediction Market Clone Softwar | Metaculus Prediction Market Clone Software