Prediction Market API Integration

Unlimited API Calls

99.97% Uptime

Sub-200ms Trade Latency

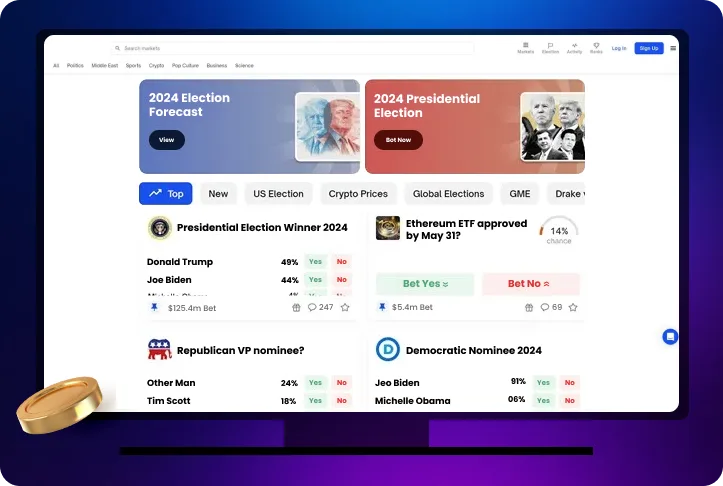

One API - Multiple Prediction Markets with TRUEiGTECH

Our API integration key connects your platform to the popular active prediction platforms in the USA and globally, delivering real-time prices, liquidity, market states, and order execution routes.

Supported platforms include

Crypto.com

Polymarket

Kalshi

Manifold Markets

Hedgehog

Zeitgeist

Get enterprise-grade connectivity and instant trading, no multiple APIs, no maintenance overload. TRUEiGTECH also integrates any prediction market API you choose for full flexibility.

Top Features of Our Best Prediction Market API Integration Solution

Multi-Market Trading

Synchronized cross-market trading with real-time data, unified pricing, and best-route execution across multiple exchanges.

Trade Execution & Order Routing

Direct in-platform execution, smart routing to the respected provider, position tracking, and crypto/fiat support for seamless user flow.

Wallet Management

Integrated custodial/non-custodial wallet support, fiat & crypto balance management, deposits/withdrawals, and secure key handling for smooth user funds workflows.

Settlement & Clearing Engine

Instant resolution settlements, automated P&L reconciliation, and audit-ready transaction records for reliable financial finality.

Developer Toolkit & SDKs

Node, Python, JS, and Go SDKs, sandbox mode, webhooks, and standardized REST/WS APIs for rapid integration.

Multi-Provider Connectivity

One API to connect multiple market providers with normalized trade execution, unified order routing, and failover handling.

Unified Market Metadata

Normalized metadata (market taxonomy, event timelines, participant data, resolution rules) across providers for consistent market discovery, filtering, and UI display.

Analytics & Reporting

Operator dashboards, market insights, trade-level analytics, and exportable reports for monitoring growth and risk.

Our Core Advantage — The Trade Execution API

Our Prediction Market API gives your users a full trading experience inside your prediction market platform from browsing markets to placing orders, managing positions, tracking P&L, and receiving settlements without redirecting them to third-party platforms.

- 40–60% higher user conversion when trades happen in-platform.

- Zero friction no redirects, no drop-offs, no switching apps.

- Real trading engine not a data feed pretending to be one.

- 10× faster integration compared to building execution infrastructure.

- Buy/Sell (Yes/No) trade execution

- Live market snapshot & latest prices pulled directly from supported exchanges

- Active & past market lists for quick market discovery and research

- Fee Revenue Earn a share of trading fees on all routed trades.

- OHLCV price history & recent updates for trend analysis and real-time data refresh

- Real-time positions, P&L, and market status

- Instant settlement when the market resolves

This is how your platform becomes a full trading environment, not just a market viewer.

Integration Architecture

We built the architecture for operators who want power without complexity.

Unified API Layer

One endpoint connects you to all providers.

Data Normalization Engine

Converts every provider’s format into one standard schema.

Execution Router

Sends user orders to the correct market instantly.

Settlement Engine

Handles clearinghouse communication and resolves P&L automatically.

Developer Controls

Logging, alerts, dashboards, usage monitoring.

What You Can Build With Our Prediction Market API

Your imagination is the only limit but here’s what operators build most often

Live event markets with Yes/No shares, instant execution, and settlement.

Seamlessly integrate Polymarket-like or crypto-native prediction flows.

Add prediction markets on top of fantasy, sportsbooks, or fan engagement apps.

Election outcomes, global events, policy decisions, all tradable.

Pull multiple providers into one super-interface for users.

Interest rate predictions, inflation outcomes, economic data releases, etc.

Enable your users to trade a new asset class without building a new system.

No matter your market, audience, or region, our API adapts.

Our 3-Step Integration Process

| Step | What Happens | Operator Role | Timeline |

| 1. Setup & Sandbox | API keys, OAuth, sandbox access, and initial test integration with one click. | Review sandbox environment, connect UI components. | 3–5 days |

| 2. Live Market Integration | Real-time market feeds, Yes/No execution, multi-provider liquidity routing, and settlement engine activation. | Validate data accuracy and trade execution workflows. | 1–2 weeks |

| 3. Go-Live & Monitoring | Production deployment, performance tuning, auto-failover verification, and compliance checks. | Launch trading and monitor initial trades; we handle monitoring. | 1–2 weeks |

| 4. Multi-Jurisdiction Setup (Optional) | Compliance verification, legal review, region-specific settlement configuration. | Coordinate with legal/compliance teams; deploy region-specific markets. | 4–6 weeks |

AI Modules That Boost Operator & Trader Value

Enhance decision-making, trading efficiency, and engagement with AI-driven insights.

Market Sentiment Intelligence

AI-driven trend analysis and real-time market summaries for instant clarity on price shifts and probability movements.

Smart Order Execution Engine

AI-driven routing, execution timing optimization, and slippage reduction across all venues automatically.

Real-Time Risk & Anomaly Detection

Monitor positions, margin exposure, liquidity stress, and unusual trading patterns proactively.

Personalized Trading Insights

Tailored market recommendations and strategy suggestions based on user behavior and trading history.

Why Operators Choose TRUEiGTECH

Prediction markets are exploding globally, and operators are racing to deploy these features without burning time on fragmented tools or custom liquidity routing. Our solution removes all the blockers

- Unified data + trading: No need to integrate multiple providers separately

- Execution-ready: Users can trade directly through your app or platform

- Revenue Share Enabled: Earn a share of trading fees from every user order routed through your platform to top prediction exchanges.

- Infra offload: 80% reduction in engineering complexity

- Cross-ecosystem coverage: Traditional, crypto, sports, political, financial markets

- Compliance-ready: KYC, risk controls, reporting

- Battle-tested scale: Designed for high-volume operators

If you want prediction markets that your users will actually trade and you want them live fast this integration does exactly that.

Customer Success Stories

Proven results across operators, sportsbooks, exchanges, and research platforms.

Major Sportsbook

Launched Polymarket + Kalshi integration in 26 days. First-month revenue: $2.1M.

Crypto Exchange

Integrated Crypto.com markets without backend rebuild. 40% daily active users now trade prediction markets.

Research & Analytics Platform

24-month historical data feed powers market intelligence tools, creating $5K/month revenue stream.

Your Queries, Answered

Do you have some questions regarding TRUEiGTECH Prediction Market API Integration ?