B2B Prediction Market Platform Development in USA

Why Prediction Markets Are Exploding in the USA

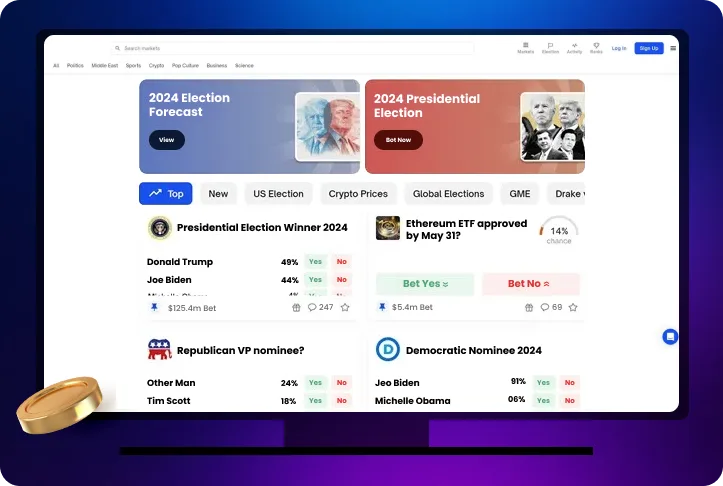

Prediction markets now see billions in monthly trading. Platforms like Kalshi alone recently crossed US$500M in weekly volume and held 62% of total on-chain activity.

Elections, inflation, rates, CPI, jobs data, hurricanes, sports leagues (NFL/NBA/MLB), all show massive retail + institutional participation.

CFTC pathways, DCM frameworks, clearinghouse alignment, and structured event-contract rules give American operators more confidence to launch.

U.S. hedge funds, analysts, and financial forecasters now use prediction markets as real-time probability engines.

Taken together, these trends create a favorable environment for U.S.-focused prediction-market solutions that deliver compliance, performance, and broad vertical applicability.

Core Features of Our Prediction Market Platforms in the USA

TRUEiGTECH offers a comprehensive feature stack built for U.S. requirements, combining trading performance, compliance, flexibility and full operational control.

Supports fiat, smart-contract, and hybrid settlement with fast, audit-ready resolution built for U.S. regulatory expectations.

Live dashboards for liquidity, volume, user behavior, sentiment, and risk, with exportable reports for monitoring and regulatory reporting.

Dynamic CLOB-powered liquidity pools ensuring continuous market access, reduced spreads, and improved capital efficiency for traders and LPs.

Hybrid CLOB + AMM engine delivering ultra-fast execution, deep liquidity, and stability during high-volatility U.S. news cycles.

Responsive, mobile-first interface enabling smooth market discovery, quick trades, portfolio tracking, and real-time updates across all devices.

Create federally compliant markets across elections, macroeconomics, weather, sports, and enterprise KPIs with CFTC-aligned settlement rules.

U.S.-ready framework with KYC/AML, geo-controls, event-type moderation, executive trade surveillance profiles, and CFTC-grade surveillance & reporting pipelines.

Manage market lifecycle, rules, disputes, moderation, and compliance workflows with granular operator permissions.

Licensing Pathways & Compliance Matrix

| Requirement | What It Means | TRUEiGTECH Advantage |

| CFTC Registration | May need DCM/clearinghouse + legal counsel | We guide architecture + documentation + attorney support |

| KYC/AML | Mandatory identity & AML verification | U.S.-standard KYC vendors integrated |

| State Geo Compliance | Each state has unique restrictions | Built-in U.S. state-level geo-fencing, and real-time AML monitoring |

| Reporting | CFTC-ready reporting structures | Exportable logs & audit dashboards |

| Corporate Setup | CEO/CTO + trade surveillance required | Guidance on compliant structure |

Use Cases: Prediction Markets for U.S. Sectors

TRUEiGTECH’s U.S.-focused prediction market software USA is well suited for a wide variety of use cases. Here are some big ones

Economic forecasts (CPI, FOMC, unemployment, rates)

Election probability trackers, sentiment-driven coverage

Internal forecasting for KPIs, project outcomes, risk models

NBA, NFL, MLB, NHL event markets, compliant formats

On-chain CLOB markets with U.S. geofencing

Why Choose TRUEiGTECH for Prediction Market Software Development in the USA

Built specifically for U.S. prediction markets with CFTC-aligned workflows, DCM/FCM-ready models, geo-fencing, attorney-assisted regulatory support, audit trails, event-type moderation, and end-to-end KYC/AML compliance baked in.

We’ve engineered Kalshi-style regulated systems, Polymarket-style platforms, hybrid Web2/Web3 markets, and enterprise forecasting tools ensuring your prediction market software in the USA is both performant and resilient.

We offer both U.S.-ready white-label prediction market platforms and completely custom builds. This flexibility helps you align the product with your brand, use cases, and regulatory risk.

Optimized for American market traffic with U.S.-region hosting, Cloudflare routing, sub-200ms execution, surge-event stability, and ADA-compliant UX across all devices.

Our multi-source liquidity engine consolidates CLOBs, market makers, and partner venues to deliver tighter spreads and higher fill rates, essential for U.S. elections, macro events, and fast-moving news cycles.

From infrastructure monitoring to feature updates, security audits, scaling, and compliance maintenance, our team supports you through the entire lifecycle of your prediction market platform.

Launch in 60–90 days with full regulatory guidance, pre-built market modules, and deployment workflows that dramatically reduce engineering overhead.

TRUEiGTECH is a credible partner in this space, supported by our proven track record in both prediction‑market and regulated financial infrastructure.

TRUEiGTECH’s Engagement & Pricing Models for Prediction Market Software in the USA

| Model Type | Setup Fee | Revenue Model | Source Code Ownership |

| Aggregator Integration | Required for deployment & environment setup | No revenue share — operator keeps 100% of trading fees | Full source code access for integration-level modules |

| Required for deployment & environment setup | Revenue share applies — shared trading fees on routed orders | No source code access (hosted model) | |

| End-to-End Exchange Development | Required for full custom or white-label build | No revenue share — operator owns all trading revenue | Complete platform source code ownership |

| Required for full custom or white-label build | Revenue share applies — lower upfront cost with shared trading fees | No source code ownership |

Integration Ecosystem TRUEiGTECH Prediction Market Software

TRUEiGTECH’s prediction market software USA is built to integrate seamlessly with a range of third-party tools and systems

Identity & Compliance

Jumio, Veriff, Socure, Sardine

Payments

Plaid, Stripe, Circle

Oracles & Resolution Feeds

Chainlink, Pyth

Risk & Surveillance

Actimize, Unit21

Enterprise Integrations

Salesforce, PowerBI, Snowflake

TRUEiGTECH Prediction Market Platform Development Roadmap

Here’s a typical roadmap when building a prediction market platform in USA with TRUEiGTECH

U.S.-focused discovery & regulatory alignment

Architecture tailored to CFTC and U.S. infrastructure

Development (trading engine, markets, compliance, liquidity)

Testing for U.S. traffic patterns & event surges

Launch (soft launch + state-level config)

Ongoing enhancements, monitoring & compliance support

Your Queries, Answered

Do you have some questions regarding TRUEiGTECH B2B Prediction Market Platform Development in USA ?