Centralized Prediction Market Development

A centralized prediction market operates like most traditional online services. A single company owns and controls the entire platform. This entity manages the servers, user accounts, funds, and the logic of the market itself while the users trust the operator to be fair and secure.

With a centralized model, operators benefit in terms of performance, speed, reliability, regulatory compliance, and ease of development and maintenance. As a leading centralized prediction market development provider, TRUEiGTECH helps businesses build powerful platforms equipped with real-time trading engines, scalable architecture, automated settlements, feature-rich admin dashboards, and compliant with CFTC.

Key Features & Capabilities of TRUEiGTECH Centralized Prediction Marketplace

Our software features reliable data feeds and oracles for event resolution, ensuring accurate settlement on real-world outcomes under CFTC-compliant protocols.

Within the centralized prediction market software, configure roles, dispute resolution, and platform policy settings to satisfy internal governance standards.

TRUEiGTECH prediction market software supports secure fiat or crypto deposits and withdrawals, custody funds safely, and reconcile payments.

We offer built-in KYC/AML, audit trails, and CFTC-compatible reporting to ensure your centralized prediction market adheres to evolving regulations.

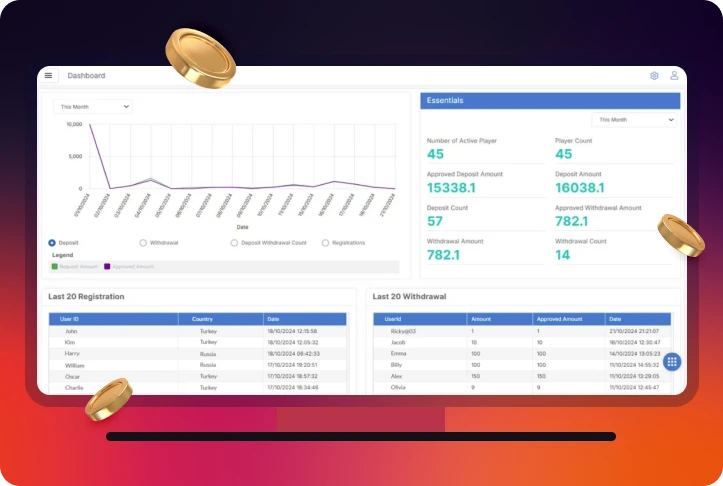

A comprehensive control panel for market setup, risk monitoring, user oversight, and CLOB order book supervision, all in one interface.

Easily create and manage binary, multi-outcome, or numeric markets with full control, designed for centralized trading on a CLOB-based prediction platform.

With TRUEiGTECH advanced prediction market software, leverage a fast, low-latency trading engine for efficient order matching and real-time price discovery.

Use automated liquidity provisioning, exposure limits, and hedging tools to manage risk and maintain orderly markets.

Dependable Centralized Prediction Market Development Services

Platform Strategy & Consulting

We help you define your prediction market vision, business model, and regulatory path that align product strategy with market potential & compliance needs.

- Deep market opportunity analysis

- CFTC-aware regulatory guidance

- Monetization & fee structure design

- Risk-mitigated go-to-market planning

Liquidity Provision & Risk Management

Our pro developers build and integrate liquidity-provisioning systems and risk controls to ensure that your markets stay deep, stable, & efficient.

- Automated market-making and exposure limits

- Internal or institutional liquidity providers

- Dynamic hedging and stress testing

- Real-time risk monitoring & alerts

Performance Monitoring & Optimization

Our decentralized prediction market development services ensure real-time analytics & optimization tools to monitor liquidity health, user activity, and trading efficiency, ensuring your platform scales robustly.

- Live dashboards tracking volume, slippage, etc.

- Automated tuning to reduce price slippage

- Alerts for abnormal or risky behavior

- Predictive system monitoring

Regulatory Compliance & Security

Our platform is designed with strong compliance features and a robust security architecture to satisfy CFTC core principles and protect user funds.

- Built-in KYC/AML workflows

- Audit-ready reporting and transaction logs

- Fraud detection and anti-manipulation tools

- Secure architecture with encryption, 2FA, etc

Oracle & Data Integration

Get access to reliable real-world data sources and oracles to resolve market outcomes accurately, quickly, and transparently with TRUEiGTECH professional services.

- API integration with trusted oracles

- Custom resolver workflows for diverse event types

- Flexible data validation and fallback logic

- Real-time event resolution

Backend & Trading Engine Development

We build a high-performance core engine with a centralized order book (CLOB) and advanced matching logic to support robust market activity.

- Low-latency, centralized order matching

- Comprehensive support for order types & trade logic

- Scalable architecture for high volumes

- Trade execution aligned with risk

Post-Launch Support & Maintenance

TRUEiGTECH centralized prediction market development services extend beyond development and launch. We offer ongoing support, updates, and compliance maintenance to ensure long-term platform stability and growth.

- 24/7 technical support and bug fixes

- Performance optimization and system scaling

- Regulatory update assistance (CFTC rule changes)

- Continuous security audits

How Does a Centralized Prediction Market Work?

- Market Creation

- Order Book (CLOB) Trading

- Liquidity & Pricing

- User Participation & Compliance

- Oracle Integration & Event Resolution

- Settlement & Payouts

Remarkable Benefits of Centralized Prediction Market Development

Scalable Infrastructure

With TRUEiGTECH, you can build a platform optimized for performance and scale, leveraging centralized servers to handle high transaction volumes without the constraints of a blockchain.

Regulatory Compliance Made Easier

With the use of centralized prediction market platforms, we allow for streamlined KYC/AML processes, audit logging, and reporting, making it simpler to comply with regulatory frameworks set by CFTC.

Revenue Potential & Business Growth

Our centralized prediction markets can generate significant fees from trading volume, market creation, & liquidity provision. These aspects create a defensible and potentially high-margin business.

User-Friendly Experience

Centralized platforms enable intuitive UX, simpler onboarding, fiat payment integrations, and customer support, making it easier to attract and retain less tech-savvy users.

You define every aspect of your markets, including resolution rules, fees, and more, giving you the flexibility to tailor the platform exactly to your business model.

With our software’s centralized order books (CLOBs), trades are matched quickly, & liquidity is concentrated. This leads to tighter spreads, lower slippage, & efficient markets.

Because you control order matching and settlement, you can offer low-latency execution and quick market resolution, improving user experience and trust.

Implement real-time risk controls like exposure limits, hedging, and automated stress tests to safeguard your platform and optimize liquidity.

TRUEiGTECH Centralized Prediction Market Development Process

Discovery & Requirements Analysis

Architecture & System Design

Data Readiness & Oracle Integration

Engine & Core Development

UI/UX Design & Admin Dashboard

Compliance & Security Integration

Testing & Quality Assurance

Deployment and Post-Launch Support

AI Solutions in Centralized Prediction Market Development

As AI becomes a mainstream force in software development, we embed intelligent, data-driven features into our centralized prediction market development solutions. These AI enhancements keep your centralized prediction marketplace cutting-edge, agile, and deeply tuned for your users.

AI can analyze user behavior, historical trades, & sentiment to suggest relevant markets. By leveraging machine learning, a centralized prediction market platform can dynamically recommend events tailored to each trader’s preferences.

AI-driven models intelligently allocate liquidity across markets by forecasting demand and adjusting bid-ask spreads. This ensures your centralized prediction marketplace remains efficient, deep, and stable, even as conditions shift.

AI delivers a highly personalized trading experience by tailoring dashboards, notifications, and insights based on individual trading history, risk profile, and sentiment. This helps in boosting engagement on your centralized prediction market platform.

With the use of natural language processing and trend detection, AI can automate the creation of timely, high-relevance event markets. This helps your centralized prediction market development stay ahead of emerging topics without manual curation.

Why Choose TRUEiGTECH for Centralized Prediction Market Development

We at TRUEiGTECH use cloud-native, scalable systems capable of handling high-concurrency trading volumes without compromising on speed or reliability.

We specialize in building centralized prediction market platforms with order-book, AI-driven pricing, and market creation modules. All of these are backed by years of domain experience.

We integrate trusted data feeds and oracles to ensure accurate, transparent, & timely event resolution and payouts.

Our prediction market platform architecture is built with compliance in mind that includes KYC/AML workflows, audit trails, & tools ready for regulated environments around the world.

pricing with no revenue share, allowing operators to retain full control & maximize profits from their centralized prediction market development software.

From consultation and launch to continuous maintenance and regulatory updates, TRUEiGTECH remains a long-term technology partner, helping your platform grow and adapt.

Statistical Highlights

Hire Centralized Prediction Market Developers

The prediction market is new as of now and this is the best time to invest in it. Whether you are new to the iGaming market or planning to extend your operations, a centralized prediction market is the way to go. With the high complexity of the process, hiring the best centralized prediction market developers is crucial and this is where TRUEiGTECH can help you.

Our developers specialize in developing a platform that uses powerful AI capabilities. This ensures transparency, accuracy, and trust in all stages of the user interaction.

Instead of just tracking hours, we focus on achieving average results; quick launch, and strong retention. This model guarantees business effects, not just code delivery.

When needed, use special pods of AI and DevOps engineers. These devices accelerate innovation, adapt to performance, and allow their platforms to scale.

Our Partners

Your Questions, Answered

Do you have some queries regarding TRUEiGTECH’s Centralized Prediction Market Development?

- Encrypted storage

- Two-factor authentication (2FA)

- Fraud detection

- Audit logs

- Exposure limits

- Hedging strategies

- Real-time risk monitoring

- 24/7 technical support

- Regular security and compliance audits

- Performance optimization

- Updates aligned with evolving regulations