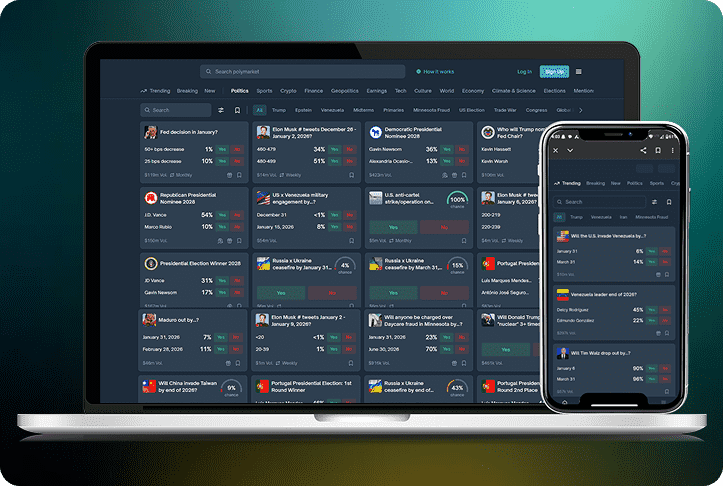

Turnkey Prediction Market Platform Development

- Go Live in 4 Weeks

- CLOB Orderbook Engine

- 20+ Modular Integrations

- 100% Audit Ready Workflows

TRUEiGTECH Turnkey Prediction Market Platform

| Turnkey Prediction Market | What You Will Get? |

| Platform Core | Fully functional prediction market platform with pre-built trading, settlement, and market management modules. |

| Trading Engines | Dual trading architecture supporting CLOB and AMM, configurable per market type. |

| Market Creation & Resolution | Admin tools to create markets, define outcomes, set rules, and automate market resolution. |

| User Management | Role-based access control, user onboarding flows, and account lifecycle management. |

| Compliance Framework | Integrated KYC/AML workflows, audit logs, geo-restriction controls, and compliance reporting. |

| Settlement & Payouts | Automated settlement engine with configurable payout logic and dispute handling. |

| Wallets & Payments | Multi-wallet support, fiat and crypto payment integrations, and transaction reconciliation. |

| Oracle & Data Feeds | Secure integration with external data sources and oracles for market resolution. |

| Risk & Integrity Controls | Market surveillance, abnormal trading detection, and integrity safeguards. |

| Admin & Operator Dashboard | Real-time dashboards for liquidity, volume, user activity, and market health analysis. |

| Analytics & Reporting | Exportable reports covering trades, users, compliance events, and financials. |

| APIs & Integrations | REST/WebSocket APIs for third-party tools, frontends, and enterprise systems. |

| Security Layer | Enterprise-grade security, including encryption, access controls, and activity monitoring |

| Deployment & Hosting | Cloud or on-premise deployment with environment setup and configuration. |

| Branding & UI Customization | White-label UI with configurable branding, layouts, and user journeys. |

| Documentation & Training | Technical documentation, admin guides, and operator training sessions. |

| Post-Launch Support | Ongoing maintenance, updates, and technical support options. |

Turnkey Prediction Market Platform Development Core Features

Integrated identity verification and transaction monitoring designed for regulated turnkey prediction market platform development.

Jurisdiction-aware enforcement of trading limits, market access controls, and compliance policies across turnkey prediction market platform development.

Real-time visibility into operator liability, market exposure, and trading concentration across all active markets.

Oracle-based resolution framework supporting automated data feeds, manual verification, dispute handling, and fallback workflows.

Configurable settlement engine supporting binary, scalar, and multi-outcome markets with automated payout calculation and reconciliation.

End-to-end market creation, approval, suspension, resolution, and audit workflows built into turnkey prediction market platform development.

High-performance central limit order book enabling transparent price discovery, spread, and efficient matching, and institutional-grade trading behavior.

Immutable, audit-ready logs capturing every trade, event update, and administrative action for regulatory and operational traceability.

Turnkey Prediction Market Platform Solutions

Regulated Market Launch Solution

- Jurisdiction Aware Marker Rules Engine and Access Controls.

- Audit-Ready Trade Logging and Resolutions.

- Integrated KYC/AML Orchestration with Compliance Reporting.

Sports or Event-Specific Prediction Markets

- Real-time CLOB Trading and Dynamic Liquidity Controls.

- Event Resolution Workflows Connected to Data Feeds.

- Market Suspension, Rollback, and Dispute Handling.

Crypto Prediction Market Platform

- Wallet-based Trading with Configurable Custody and Transactions.

- Resolution Layer with Multiple Data Sources Linked to Oracles.

- Token-based Settlement Logic and Configurable Payout.

Customized Prediction Market Models

- Binary, Scalar, and Multi-Outcome Market Configuration.

- Custom Payout and Settlement Logic Aligned to Market Mechanics.

- Operator Controls for Liquidity, Spreads, and Exposure.

TRUEiGTECH in the News | Featured in Top Media Outlets

Recognized and covered by leading global media platforms across the technology and iGaming ecosystem. Explore our recent press releases featured in top-tier publications.

Benefits of TRUEiGTECH’s Turnkey Prediction Market Solution

TRUEiGTECH enables businesses to launch secure, compliant, and scalable markets faster with a complete turnkey prediction market software stack built for global operations.

Our pre-built engines and modular components accelerate testing, deployment, and iteration, enabling you to launch a fully operational prediction market platform in weeks instead of months.

The platform includes integrated KYC/AML flows, geo-controls, audit trails, and regulatory governance frameworks, with support for navigating global licensing requirements.

Engineered for real-time trading, high concurrency, and heavy traffic loads, the system auto-scales during spikes while maintaining low latency and seamless user experience.

Every layer is customizable, from market logic and settlement rules to UI/UX, multilingual support, and branding, giving you full control over your platform’s identity.

A hardened security architecture protects against manipulation, fraud, and market abuse, with optional smart-contract audits for blockchain-enabled deployments.

We provide ongoing monitoring, maintenance, feature upgrades, and scaling assistance to ensure your platform runs smoothly as you expand into new markets and geographies.

Turnkey Prediction Market Platform Development Process

Deployment Process of Turnkey Prediction Market Software

We evaluate business models, target jurisdictions, and operational workflows to define market structure and compliance needs for your prediction market platform.

Trading engines, liquidity models, branding elements, databases, and security frameworks are configured to create a fully functional turnkey prediction market platform.

We connect the platform to external data sources, oracle networks, payment gateways, identity verification tools, and any required enterprise systems.

Load tests, penetration checks, regulatory reviews, and functional validation ensure your turnkey prediction market software performs reliably under real-world conditions.

The platform is moved to production, initial markets are activated, liquidity is configured, and your prediction market platform becomes ready for public or internal use.

Post-launch, our team monitors uptime, optimizes infrastructure, adds new features, and scales your turnkey prediction market platform across regions and market verticals.

Compliance & Legal Support

Prediction markets operate within complex regulatory environments, and TRUEiGTECH ensures your turnkey prediction market platform meets global standards from the start. Our legal and compliance teams integrate licensing, audit trails, AML controls, and market integrity frameworks into your core system.

We determine whether your platform is classified under gaming, fintech, research, or derivatives, then map a jurisdiction-specific compliance roadmap and conduct risk assessments for cross-border operations.

Our team provides guidance for CFTC, NFA, ESMA, FCA, and other regulators, supports application and documentation preparation, and advises on FCM, DCM, MTF, and similar license paths when applicable.

We integrate identity verification systems, AML transaction monitoring, risk scoring tools, and geo-restriction workflows to ensure users access your platform in compliance with regional regulations.

We help draft internal policies, compliance manuals, and reporting frameworks, along with audit-ready documentation that satisfies regulatory partners and oversight bodies.

Our market surveillance tools detect spoofing, wash trading, and manipulation, supported by post-trade analytics, order book monitoring, and optional integration with third-party surveillance providers.

Why Choose TRUEiGTECH Turnkey Prediction Market Platform Development?

Custom-built prediction markets take months, but turnkey prediction market software development is pre-engineered with modular trading, settlement, and compliance layers. This ensures you can launch in weeks and not months.

As operators struggle to enforce jurisdiction-specific rules and maintain audit readiness, our turnkey prediction market platform has a built-in rules engine, audit-grade logging, and compliance workflows for faster approvals.

Where poor liquidity design undermines trust, we build a CLOB engine giving you liquidity controls and integrity monitoring, leading to stable markets, stable price discovery, and building user confidence from day one.

With TRUEiGTECH as your turnkey prediction market software development partner, get an oracle-agnostic resolution layer with verification, dispute, and fallback workflows.

Instead of fragmented management systems, work with a centralized operator console with role-based access control and a real-time risk dashboard for faster and transparent resolutions.

Post-launch support can easily become dependent, but with us, operators get self-serve tools, APIs, and integrations integrated into the turnkey prediction market software, leading to faster iterations.