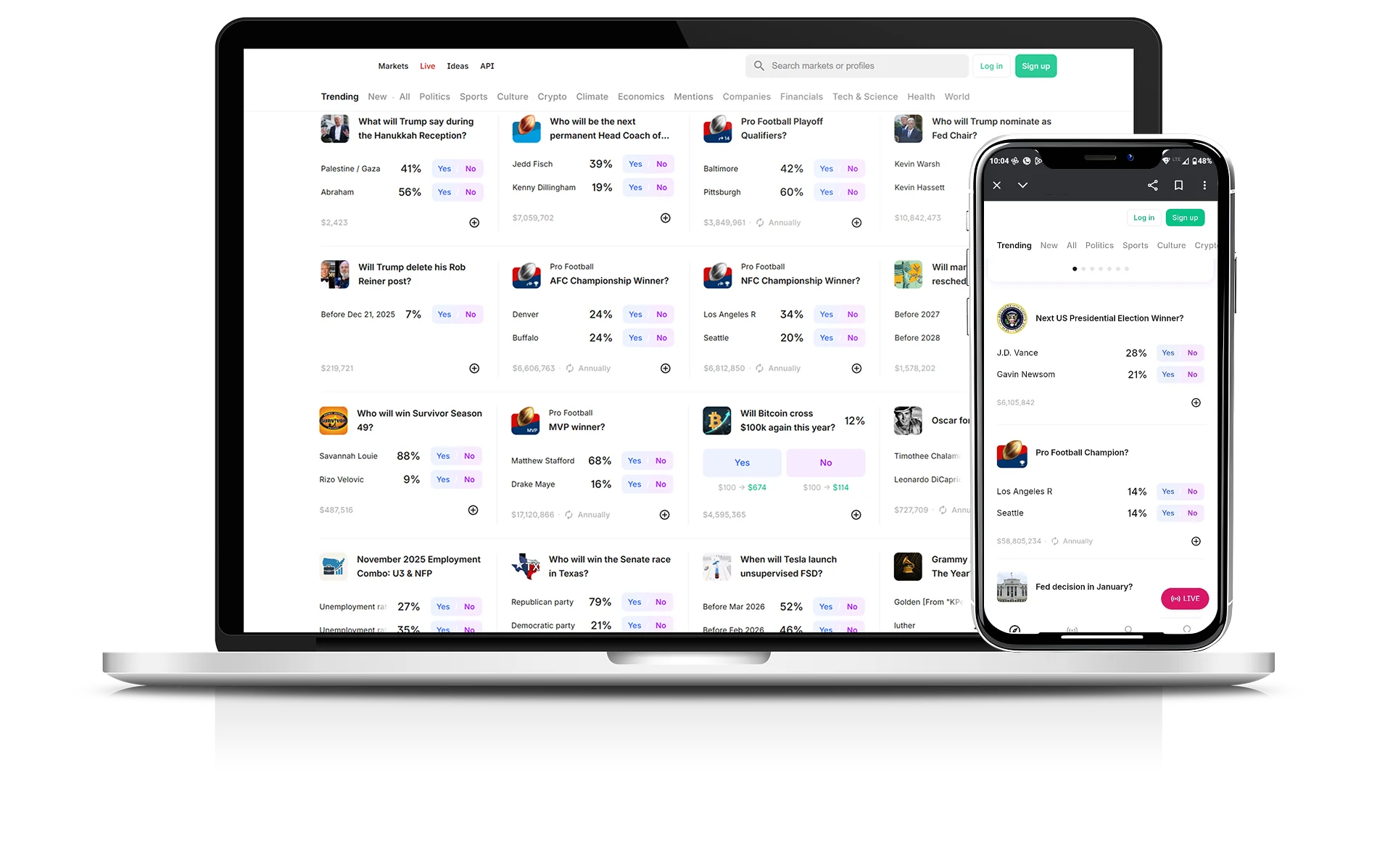

Launch CFTC-Compliant

Prediction Market Platform

20+

Platforms Delivered

08

Weeks Launch Time

100M+

Prediction Volume

10M+

Trades Executed

400K+

Active Players

3

Prediction Market APIs

Prediction Market APIs

Rapid Launch & Expansion

What We Deliver?

- Launch Ready Prediction Market Platform.

- Operator Dashboards for Market Control, Oversight, and User Engagement

- Multiple Market Models (Binary, Multi-Outcome, and Scalar).

- CLOB-based Liquidity Model Trading Engine.

- AI-Assisted Market Intelligence.

Prediction Market Platform Development

A prediction market is a platform where participants trade contracts based on the outcome of future events. Operators list events, users place trades on possible outcomes, and market prices adjust according to the collective opinion of the registered users.

When events conclude, contracts settle automatically, and winnings are distributed based on the actual outcome. The result is a transparent, verifiable, and as the premier prediction market provider we embed a data-driven system where market dynamics generate actionable insights, engage users, and create revenue opportunities for operators.

Read More About Prediction Markets and its Features Here!

Key Features of Prediction Market Platform Solution

Deep behavioral analytics, trader segmentation, and P&L distribution tracking, giving operators insights similar to FCM/DCM environments to optimize engagement and retention.

consolidated interface that manages market states, trading limits, liquidity injection, user KYC/AML, geo-compliance, fee structures, with advanced controls for tighter jurisdictions.

Accurate settlement through multi-source oracle feeds, cryptographic audit logs, dispute windows, forced settlement controls, and post-resolution validation to preserve trust and integrity.

Operators can deploy Binary, Multi-outcome, and Scalar (range-based) markets, mirroring structures used by platforms like Kalshi and Polymarket, enabling diverse trading and broader user participation.

Built-in algorithmic MM tools generate continuous quotes, maintain min/max spread rules, and dynamically adjust pricing based on volatility, effectively reducing the need for manual intervention.

Execute trades through a high-performance Central Limit Order Book (CLOB) with microsecond matching, ensuring operators deliver accurate pricing, deep liquidity, and institutional-grade execution flow.

Automate market creation, scheduling, activation, and settlement through rules-based workflows, batch schedulers, reducing operational overhead and preventing lifecycle errors.

Our prediction market platform supports Automated Market Maker (AMM) liquidity pools, operator-managed reserves, and real-time liquidity depth dashboards to keep spreads tight and markets active.

Prediction Marketplace API Integration

Seamlessly integrate prediction-market functionality into existing apps using scalable, modular prediction market APIs from the leading marketplaces. With TRUEiGTECH, you can build ready to deploy prediction platforms.

Prediction Market Deployment Models | TRUEiGTECH

Turnkey Prediction Marketplace Software Development

A plug-and-play turnkey prediction market platform deployed with end-to-end setup, configuration, hosting, and operational support ready to start generating revenue immediately.

- Complete deployment including hosting, integrations, and system setup.

- Preloaded AI-driven market templates and automated resolution systems.

- Regulatory, liquidity, and security configurations handled by experts.

- Hands-off launch with full operational readiness.

Custom Prediction Market Software Solutions

A fully tailored custom prediction market platform built to match unique business logic, workflows, and market mechanics delivered in record time with region-specific features.

- Bespoke UI/UX, pricing models, and liquidity frameworks.

- Custom event types, multiple market types covered.

- Integrates with proprietary operator dashboards and third-party feeds.

- For operators building a differentiated, long-term prediction ecosystem.

Prediction Market Platform Development Solutions

Prediction Market Clone Script Development

Launch prediction market platform solutions inspired by Polymarket, Kalshi, or Augur with ready-made clone architectures.

- Recreate proven prediction-market models with custom enhancements.

- Supports AMM, order book, or hybrid liquidity structures.

- Faster development cycle with battle-tested modules.

- Flexible for operators targeting US, EU, or global jurisdictions.

Centralized Prediction Market Development

Build a fully controlled, centralized prediction market platform where operators manage liquidity, outcomes, and user experience from a unified backend.

- Operator-managed markets, liquidity, and settlement logic

- Real-time risk controls and market moderation

- Seamless user onboarding with custodial wallets

- Regulatory alignment for region-specific compliance

Decentralized Prediction Market Development

Launch blockchain-based prediction markets powered by smart contracts, on-chain settlement, and decentralized oracles.

- Smart contract–driven market creation and resolution

- On-chain AMM liquidity pools and tokenized positions

- Oracle integrations for transparent outcome verification

- Transparent rules and oracles for trust-minimized resolution.

Event-Based Prediction Market Development

Launch event-driven prediction market platforms focused on real-world outcomes across sports, finance, politics, entertainment, or custom verticals.

- Custom event creation and outcome modeling

- Time-bound markets with automated resolution workflows

- Support for binary, multi-outcome, and scalar markets

- Flexible settlement logic based on verified data sources

Rapidly Deployable Prediction Marketplace Platform

Launch a prediction market platform clone within 30 days with TRUEiGTECH. Using clone scripts of popular prediction marketplaces like Polymarket, Kalshi, Probo, Zeitgeist, and many more, we provide ready to launch solutions while retaining the core functionalities but customizing the design, features, or anything you need.

Why Partner with TREUiGTECH for Prediction Market Platform Development?

TRUEiGTECH, a top prediction market platform development company, provides prediction market platforms engineered to perform, ensure regulatory confidence, and long-term scalability. Our expertise spans from building end-to-end prediction marketplace platforms to marketplace clones, and event-driven architecture.

We bring deep specialization in AMM-based pricing, order-book engines, oracle-driven resolution, multi-outcome market design, and high-frequency trading infrastructure built specifically for prediction platforms.

Our systems are designed with compliance at the core, supporting licensing workflows, KYC/AML logic, geo-restrictions, user-tier rules, audit logs, and region-specific trading frameworks essential for U.S. and global markets.

Whether it’s sports, politics, macroeconomics, crypto, entertainment, or enterprise-specific internal forecasting, TRUEIGTECH prediction marketplace platform supports any category, data feed, or event type you need to operate.

With smart-contract audits, fraud detection models, real-time surveillance, and enterprise-grade encryption, we protect user funds, preserve market integrity, and maintain institutional trust.

We build intuitive and branded trading experiences, from streamlined dashboards to advanced market creation tools, where everything is optimized for onboarding and retention.

Our platform includes structured market templates with predefined metadata, tags, liquidity settings, time windows, and AI-driven system, allowing operators to launch high-quality markets consistently and at scale.

Create Diverse Variety of Events with TRUEiGTECH Prediction Market Platform

With TRUEiGTECH prediction market software you or your users can create unlimited events and markets within events based on popular opinion, current news, and live happenings.

The TRUEiGTECH team can also build new markets for your platform according to trends, regional events, and your preferences to ensure your prediction marketplace platform becomes the most popular platform in the industry.

AI-Empowered Prediction Marketplace Platform Development

Scans news feeds, social trends, price movements, and historical signals to suggest high-demand markets helping operators publish relevant events.

AI-Driven Event Creation

Scans news feeds, social trends, price movements, and historical signals to suggest high-demand markets helping operators publish relevant events.

AI-Based Liquidity Allocation

Suggests where to inject liquidity or adjust AMM parameters based on real-time market depth, user behavior, and spending patterns.

Predictive and Sentiment Analytics

Uses machine learning to read market sentiment, order flow, and external signals, helping operators spot momentum shifts early and launch markets users actually want.

Smart Notification Engine

Our prediction marketplace platform sends users relevant alerts based on their preferences and real-time market conditions, not generic broadcasts.

Hire the Best Prediction Market Software Development Company

Launching a prediction platform takes more than code. You need a team that understands the evolving industry requirements, trading mechanics, liquidity, compliance, and how real users behave. We build prediction market platforms that are fast to launch, reliable under pressure, and ready to scale.

Our Prediction Marketplace Software Development Process

Tech Stack for Prediction Market Platform Solutions

- React.Js

- Swift - iOS

- Next.Js

- Kotlin - Android

- Node.js

- MySQL

- gRPC

- MongoDB

- Redis

- AWS

- Jenkins

- Docker

- Apache JMeter

- OWASP

- sonarQube

- Firebase

- News APIs

- Weather Forecasting APIs

- Sports Odds

- FX Data

Testimonials

Your Queries, Answered

Do you have some questions regarding TRUEiGTECH Prediction Market Software Development?

- Binary markets: Yes/No outcomes with prices reflecting probability. Ideal for elections, approvals, milestones.

- Scalar markets: Continuous-value predictions (e.g., BTC price, CPI range) using range-bound settlement formulas.

- Multi-outcome markets: Multiple discrete outcomes (e.g., sports brackets, award winners) with independent liquidity pools or shared-order books.

Latest News

Forbes is Preparing to Launch a Play-Money Prediction Market

Media giant Forbes is having a troublesome time as its engagement and search traffic is going down and is planning to enter the prediction markets industry, but with a different approach. Users need not stake money to participate in predictions, but they will use tokens to make predictions and build their profiles. The events added to Forbes Prediction Market will be connected to the news and other information covered in Forbes. This move is meant to increase engagement and traffic to the Forbes website.

Prediction Markets Face Insider Trading Crackdown: Tools Hunt "Next Big Bets" on Polymarket Amid Maduro Scandal

Insider trading probes are heating up in prediction markets like Polymarket, fueled by suspiciously winning bets before Nicolás Maduro's ouster from Venezuela's presidency this month. Unusual Whales launched a tool to detect shady activity, with CEO Matt Saincome warning: "The next big insider trade might be in prediction markets." Rep. Ritchie Torres (D-N.Y.) pushes a bill banning federal officials from policy-tied trades using non-public info. Meanwhile, Kalshi faces a Massachusetts injunction blocking unlicensed sports contracts, as AG Andrea Joy Campbell slams unregulated gaming. Billion-dollar platforms drove 25% FinTech funding surge in 2025, but critics see gambling risks without oversight.

Goldman Sachs is Looking for Opportunities to Enter Prediction Markets

Goldman Sachs is exploring new opportunities to enter prediction markets, seeing to the skyrocketing progress of this industry. During the bank’s fourth quarter earnings call, the CEO David Solomon shared how he met with leaders of major prediction markets companies. This shows that now even traditional finance institutions are moving towards this emerging sector.

Turnkey Prediction Market Platform | Bespoke Prediction Market Software | Crypto Prediction Market Platform | Blockchain-Based Crypto Prediction Platform | Centralized Prediction Market Development | Decentralized Prediction Market Development | Sports Prediction Market Platform | Top Prediction Market Platform Providers | Prediction Market Platform Development USA